University Press few days ago released its audited FY 2025 results. The company is one of three firms in that space listed on the NGX, the others being Learn Africa and Academy Press.

Topline and bottomline growth

There was decent topline and bottomline growth, year on year. Revenue rose 29.2% from N2.6 billion in 2024 to N3.4 billion in 2025.

The company returned to profit as it made N450 million in profit after tax, as against a N157 million loss recorded in 2024.

Tiny dividend

Initial market reaction was poor as the company declared a rather tiny dividend, though it went up massively year on year.

The firm has proposed a 15 kobo dividend, up from the 2.5 kobo dividend paid for the prior year.

Qualification date for the dividend is the 22nd of August, 2025.

Payment date for the dividend is the 18th of September, 2025.

Earnings per share (profit per share) was N1.04, meaning it paid out 14.3% of its earnings.

For a stock that trades a bit above N5, that’s a dividend yield of less than 3%.

Underlying numbers are soft

If you strip away the other income of N407 million, the company would have made a profit after tax of N43 million.

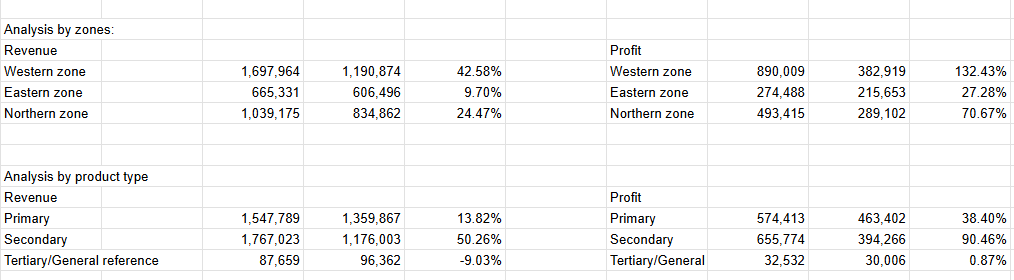

Geography and Category split

View

I am bearish on University Press due to the weak underlying numbers. Q1 2026 numbers should provide a bit more clarity. Learn Africa seems to be a better choice in that space.

Overall, these stocks are best held for dividend plays. So one would have to go in when the price would give a dividend yield of at least 10%.

I dont see earnings growing beyond 15% to 25% per annum.

The stock is trading at a market capitalization of N2.3 billion which is lower than its total equity of N3.4 billion. So in the short term, there may be some upside.

Leave a Reply