Livingtrust Mortgage Bank had a higher growth in profit in Q2 2025 compared to the previous quarter. In terms of valuation, the stock seems to be a bit pricey going by price to book value

About the firm

Livingtrust Mortgage Bank Plc was incorporated on March 9, 1993. The Bank converted from a Private Limited Liability Company to a Public Limited Liability Company on January 25, 2013 and subsequently listed on the Nigerian Stock Exchange on December 11, 2013 where its shares are being publicly traded. The principal activity of the Bank is the provision of mortgage financing, Real Estate Construction finance amongst other banking services to individuals, groups and corporate entities.

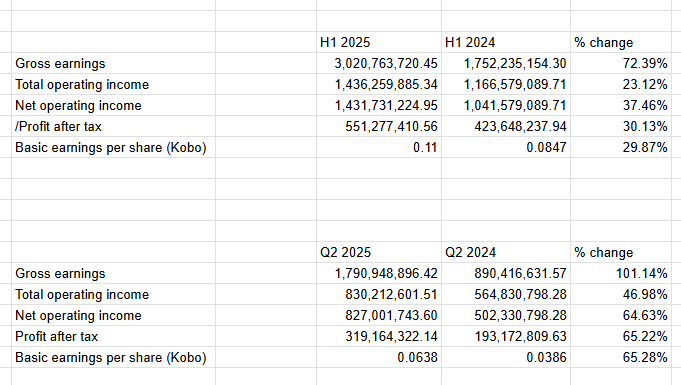

H1 2025 results

There was decent year on year increase in both revenue and profit.

Revenue rose by72.3% from N1.7 billion in 2024 to N3 billion in 2025.

Profit after tax rose at a much slower pace from N423 million in 2024 to N551 million in 2025, up 30.1% year on year.

Q2 2025 results had better growth

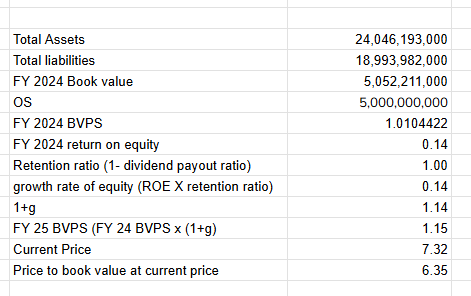

What’s a fair price ?

Livingtrust Mortgage closed last Friday’s trading session at N7.32. That would mean it is trading at about 6 times book value.

Even the FUGAZ banks (Firstholdco, UBA, GTCO, Access and Zenith) that are much bigger, arent trading at such high prices. Most expensive FUGAZ trades at around 1 times book value

If its H1 2025 earnings per share of 11 kobo is replicated in the second half, it would bring full year earnings per share to 22 kobo. At its current price, that would mean the stock is trading at over 30 times earnings.

In the last 5 years, the firm has grown its earnings at a CAGR of 44% and revenue at a CAGR of 50%

Which should take precedence? Book value? Or earnings growth?

Will there be a new key investor?

40% of the bank’s shares are held by Citirust Holdings.

A Federal High Court sitting in Ikoyi ordered their forfeiture. Most likely, the company would appeal. If they lose, it would mean the bank would have a new key investor (if the Osun State government does not buy the shares).

Leave a Reply