PZ Cussons Nigeria yesterday released its audited FY 2025 results (financial year for the 12 months ended May 2025), after trading hours. Here is a walkthrough the numbers and my view on the stock.

About the firm

PZ Cussons Nigeria Plc was incorporated in Nigeria on 4 December 1948 under the name of P.B. Nicholas and Company Limited. The name was changed to Alagbon Industries Limited in 1953 and to Associated Industries Limited in 1960.

The Company became a public Company in 1972 and was granted a listing on the Nigerian Stock Exchange. The name was changed to Paterson Zochonis Industries Limited on 24 November 1976 and in compliance with the Companies and Allied Matters Act 2020 as amended, it changed its name to Paterson Zochonis Industries Plc on 22 November 1990.

On 21 September, 2006, the Company adopted its present name of PZ Cussons Nigeria Plc

Principal activities

The principal activities of the Group are the manufacture, distribution and sale of a wide range of consumer products and home appliances through owned depots. The Group also facilitates the distribution of products of a related entity – Harefield Industrial Nigeria Limited.

FY 2025 results

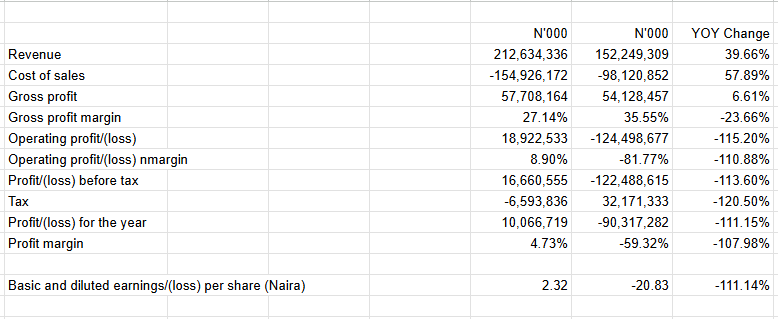

Revenue rose by 40% from N152.2 billion in 2024 to N212.6 billion in 2025.

The firm recorded a N10 billion profit after tax in 2025, as against a N90 billion loss recorded in 2024.

View

The stock closed Friday’s trading session at N32. That means the stock is trading at a price to earnings ratio of 15 times earnings.

In the last 5 years, the price to earnings ratio for this firm has ranged between -8.3X to 25.8X.

While its not pricey, Q1 2025 numbers would give clarity as to how the current financial year will shape out.

The stock is a HOLD in my view. A HOLD is a neither buy or sell view.

This is not financial or trading advice. Please do your own research.

Leave a Reply