Eterna Plc, a company in the downstream oil and gas space on the NGX, currently has a rights issue. A rights issue allows a company to offer additional shares to its existing shareholders.

Here are my thoughts on the offer and where the stock should be trading at going forward.

This is not investment advice, and opinions may change at any time. I or other team members may currently hold positions in the stock or acquire them after this post goes up.

The offer details

A Rights Issue of 978,108,485 Ordinary Shares of 50 Kobo each at N22.00 per share, offered on the basis of three (3) new Ordinary Shares for every four (4) Ordinary Shares held as of the close of business on November 27, 2025.

The issue opened on JANUARY 12, 2026 and will close on FEBRUARY 18, 2026.

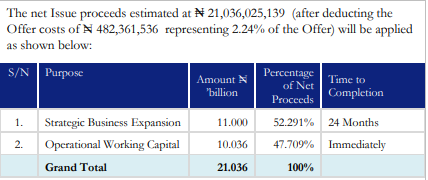

What will the proceeds be used for?

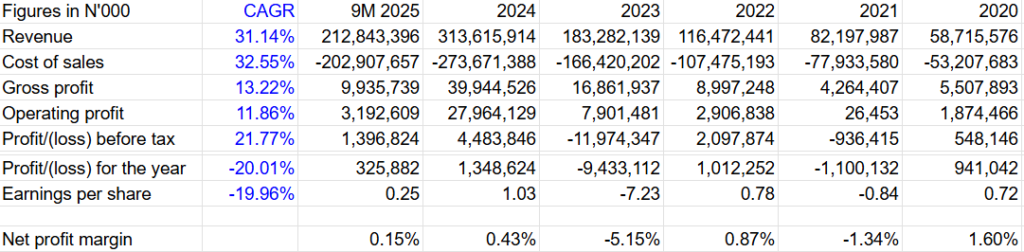

Eterna Plc’s margins are thin

In the last nearly 6 years, Eterna Plc’s revenue has grown at a CAGR (compound average growth rate) of 32%, but profit after tax and net margins have dipped. The thin margins are a typical feature of players in the downstream space.

The industry has also come under pressure in the last few years due to the devaluation of the Naira in 2024 and of recent the Dangote refinery. The presence of the refinery has made imports less competitive and narrowed the price margins.

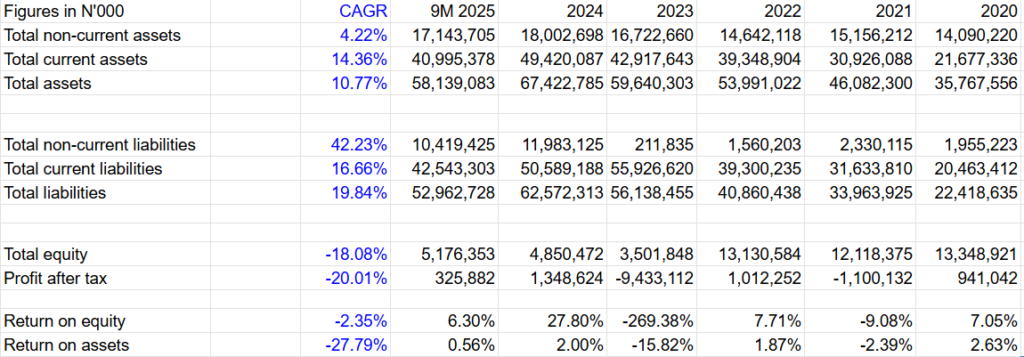

ROA and ROE have been poor

Return on Assets (ROA) and Return on Equity (ROE), have been patchy over the last few years.

ROE is a financial ratio that measures how efficiently a company generates profit from the money invested by its shareholders.

Eterna Plc’s 6.3% ROE means that for every 100 Naira (or other currency unit) of shareholders’ equity, the company generated approximately N6.3 in net income (profit).

ROA is a key financial metric used to evaluate how efficiently a company uses its total assets to generate a profit.

An ROA of 0.56% means the company generates 5.6 kobo in profit for every N1 in assets it owns.

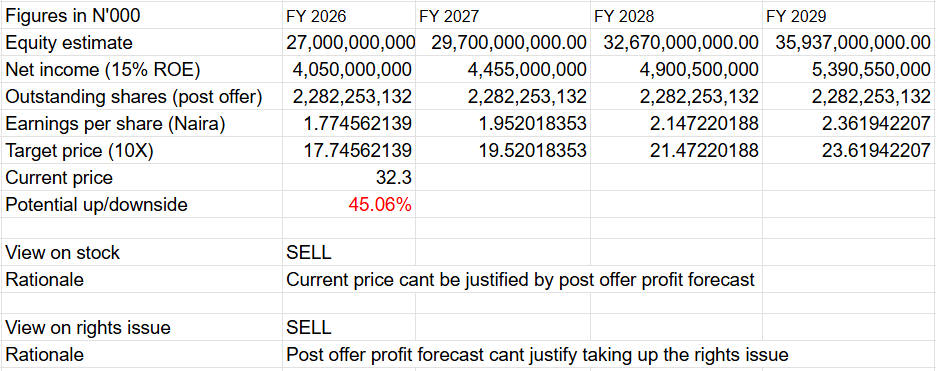

Forecast/View on the rights and issue and stock

In my view, Eterna Plc’s stock and the rights issue are a NO at the moment, even though the rights are priced at a discount to the company’s current share price. Future profit forecasts do not justify the current price of N32,30, and the rights issue price of N22. .

An ROE of 15% in the near term may be a tall order, given it will take 24 months for business expansion.

Leave a Reply