VFD Group is a firm I’ve followed keenly for the last few years. Team has a lot of chutzpah and makes bold moves.

A few years ago, they tried to acquire NEM Insurance, but it didnt pull through (that should have been a signal for me to buy NEM, but i guess i was more focused on covering the news).

Yesterday, they released their audited FY 2024 results. The statements also provided some insights into their holdings in various firms.

About the firm

VFD Group Plc was incorporated on 7 July 2009 as a private limited liability company. It commenced operations on 21 December 2010.

Its name, formerly Viadaz FD Limited, was changed to VFD Group Limited by a special resolution of the Board on 1 February 2016..

The name of the Company was again changed to VFD Group Plc by a special resolution of the Board and with the authority of the Corporate Affairs Commission on 28 January 2019.

The principal activity of the Company is to carry on business as an investment company and for that purpose to acquire and hold either in its name or that of any nominee, shares, stocks, debentures and other securities issued by any company wherever incorporated. The principal activities of the subsidiaries cover real estate and hospitality, logistics and haulage, lending and technology services.

FY 2024

Gross earnings grew by 95% from N45.3 billion in 2023 to N87.7 billion in 2024

The firm returned to profitability last year. It made a profit after tax of N8.6 billion as against a N750 million loss in 2023.

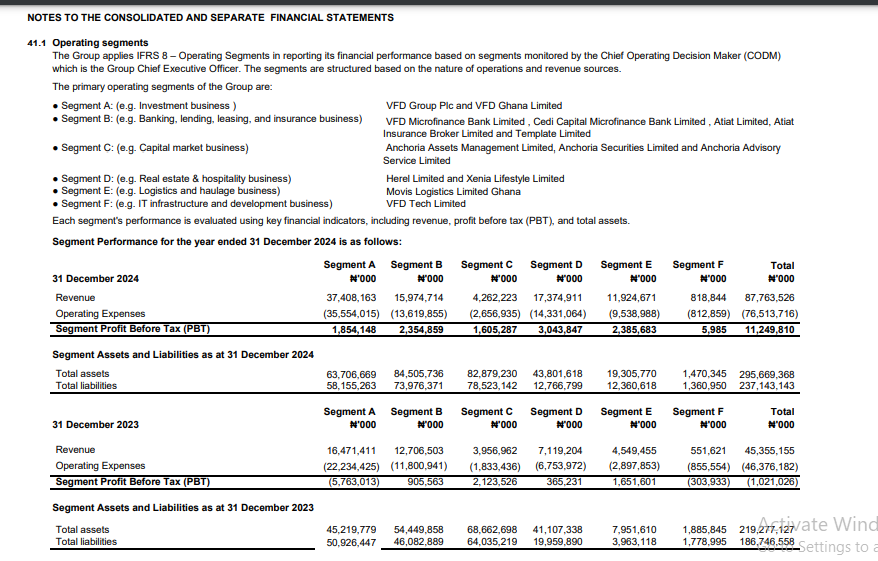

Here is a snapshot of the various segments.

Is there a dividend ?

There is no word of a dividend from the firm. It does have healthy retained earnings.

Gearing still too high

While the gearing ratio has dropped, it remains a bit too high in my view.

Portfolio moves

VFD sold down their stake in Abbey Bank to 5%. That makes me wonder. What’s the next move in the banking space? Are they going to inject more funds into VFD Microfinance Bank?

In February 2025, the Group completed the sale of its entire interest in ATIAT Limited, a subsidiary engaged in leasing and financing.

The divestment was executed through the sale of 343,546,646 shares representing 57.2% stake to ATIAT Limited for a total consideration of N7.214b.

The disposal aligns with the Group’s strategic direction to focus on core operations and invest the proceeds to acquire investments that would generate more returns and align with its strategic goal.

Kairo Capital Limited was renamed Anchoria Advisory Services Limited.( Anchoria Investment and Securities Limited was renamed Anchoria Securities Limited.

In addition, Xenia Lifestyle Limited ceased to be a subsidiary during the year following its absorption by Herel Limited.

A new subsidiary, Template Limited was incorporated on 23 June,2023 and commenced operations in March 2024. The Company has a money lender license issued by the Lagos state government.

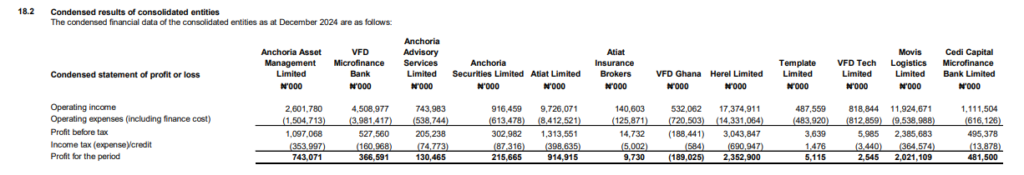

Below is a breakdown of the subsidiaires and their performance in FY 2024

I am sure management has their strategy, but i feel the multiplicity of firms in the financial services space would be better under a bank. Then VFD holds a majority stake.

Smaller but popular names

The firm also has interests in a few smaller but popular businesses in Lagos.

E’Bar Metro

The principal activities of the EBAR Metro is serving as a bar for relaxation and leisure, offering homestyle cookings.

The Group holds an equity interest of 49,166,667 ordinary shares of N1 each in E’Bar Metro as at 31 December 2024, representing 20% equity participation in the company.

No dividend income was received from E’Bar during the year. As at 31 December 2024, the value of the investment was N159 million.

HSE Gourmet Limited

The principal activity of HSE Gourmet Limited is offering comfort-food style restaurant services.

The Group holds an equity interest of 370,000 ordinary shares in HSE Cafe Ltd as at 31 December 2024, representing 37% equity participation in the company.

No dividend income was received from HSE Cafe Ltd during the year. As at 31 December 2024, the value of the investment was N160.9 million.

Leave a Reply