Good morning and welcome to this week’s edition of Bulls and Bears. Bulls and Bears is a weekly thread I do on the NGX (Nigerian stock market) and US equities. Sometimes i add a pinch of other things like European equities and crypto.

This thread goes up on my substack by 10am link in bio. It goes up here by 11am

Starting with the NGX. Last week was a good one as the All Share Index which measures the average performance of stocks on the exchange gained 1.8%

Multiverse was the best performing stock. The stock gained 53.42% to close at N12.35

Sunu Assurances led last week’s losers. The stock declined by 36.52% to close at N7.30

GTCO (parent company of GT Bank) announced the successful completion of the first tranche of its equity raise. N209 billion was raised from 130,617 valid applications for 4.7 billion shares.

In the release, the company stated it would commence the second phase of its capital raise which would be strategically positioned for foreign investors.

FBN Holdings (parent company of First Bank) issued a press release following a media publication on the call for an Extraordinary General Meeting (EGM) by two of the company’s shareholders.

The firm stated that

“This matter does not in any way impact the operations of the Company; and all the businesses within the Group continue to provide uninterrupted services to its customers. We assure our valued customers, shareholders, investors, other stakeholders and the general public that we are taking all necessary steps to protect the interests of the Company and its subsidiaries”

Board and management changes

Jaideep Paul, Airtel Africa’s Chief Financial Officer (CFO) will retire with effect from the end of the 2025 July AGM. Jaideep will be leaving the Company to pursue a new position within the wider Bharti Group. Kamal Dua, currently Deputy CFO will become an Executive Director and assume the role of CFO following his appointment at the 2025 AGM.

Bolaji Odunsi, an Independent Non-Executive Director on UAC’s board will retire effective 31 March 2025. Odunsi joined the Board in October 2018 and most recently chaired UAC’s Board Risk Management Committee.

We had a couple of insider dealings during the week. Nothing major. You can see the insider dealings for the month of January, here

What’s happening this week on the NGX?

We should have a bit more colour from other banks and financial institutions that have raised money.

On the macro front, we should get December 2024 inflation numbers from the NBS within the week. Hopefully their website pulls a Lazarus.

To the United States

Last week was a downer following stronger than expected jobs numbers. That lends more credence to the central bank to pause or reduce the magnitude of interest rate cuts.

The S&P 500 declined 1.9%. Same with the Dow

The NASDAQ Composite fell by 2.3%

Facebook CEO Mark Zuckerburg in his appearance on the Joe Rogan podcast hailed the Iphone as one of the most important inventions of all time but took shots at the firm criticizing their app commissions and a lack of innovation.

“It’s like Steve Jobs invented the iPhone and now they’re just kind of sitting on it 20 years later”.

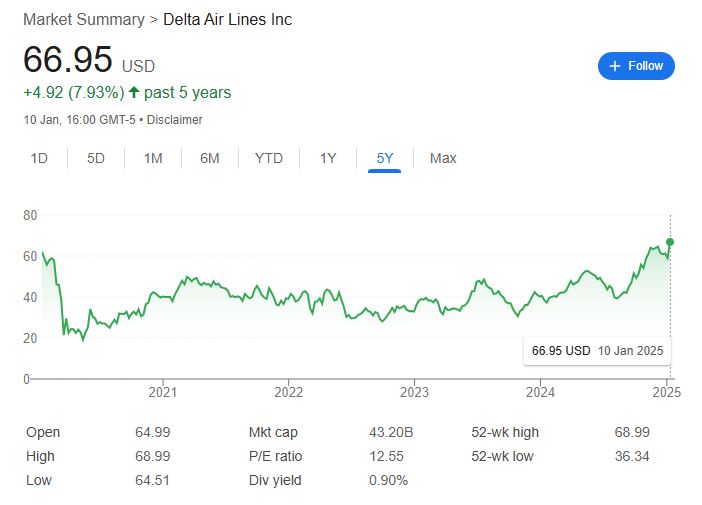

Delta Airlines dropped recorded Q4 numbers.

It made $14.4 billion in revenue and an earnings per share of $1.85

CEO Ed Bastain stated We are looking at 2025 as our all time best year.

The stock touched a fresh 5 year high and gained 13.3% last week.

What’s happening this week?

This week earnings season kicks off proper in the United States. Banks and other firms in the financial space tend to be the first to start.

On Wednesday, JPMorgan Chase , Wells Fargo, BlackRock, Citigroup, Goldman Sachs and Bank of New York Mellon, will report.

United Health, Bank of America , Morgan Stanley, U.S. Bancorp,and M&T Bank, are due to issue numbers on Thursday.

Schlumberger and State Street reports Friday.

Inflation numbers for December will be out on Wednesday. Most of the forecasts I have seen are sub 3%. I think we could remain within that mark.

Retail sales numbers will be out on Thursday. A huge chunk of the US economy is driven by consumption so retail spending is a key metric to watch.

Have a great week ahead

Please follow on

IG: greentickerwarrior

IG: greentickertales

Leave a Reply