Good morning and welcome to this week’s Bulls and Bears. This is a weekly thread on the NGX and US equity space.

If you have any questions, feel free to tweet at me. You can also send an email to info@greentickertales.com or use the anon link

Starting with the NGX

The market opened for four trading days last week as the Federal Government declared Tuesday July 15, 2025, as public holiday in honour of the late former president of the Federal Republic of Nigeria, Muhammadu Buhari GCFR.

Trading in the top three equities, namely First Holdco Plc, FCMB Group Plc and Fidelity Bank Plc (measured by volume), accounted for 13.229 billion shares worth N367.498 billion in 10,083 deals, contributing 75.60% and 73.39% to the total equity turnover volume and value respectively.

The NGX All-Share Index appreciated by 4.31% to close the week at 131,585.66 points.

Market capitalization closed the week at N 83.241 trillion respectively.

Eunisell Interlinked led last week’s gainers. The stock appreciated by 32.59% opening at N13.50 and closing at N17.90, up N4.40.

Other notable gainers were Dangote Cement, BUA Cement and Nestle Nigeria.

Academy Press led the losers. The stock fell 24.32% opening at N9.25 and closing at N7, down N2.25.

Linkage Assurance, Fidson Healthcare and Jaiz Bank were marked down during the week. A markdown is when a stock is adjusted downwards for a dividend or bonus.

Linkage Assurance was marked down for a 1 for 5 bonus. Ex bonus price was N1.33

Fidson was marked down for a N1 dividend and ex dividend price was N45

Jaiz Bank was marked down for a N0.07 dividend and ex dividend price was N3.53

RC Limited takes up 25% stake in FirstHoldco

Biggest headlines this week were the heavy trades in FirstHoldco, Fidelity Bank and FCMB

If its TLDR,

You can get the abridged version here

For the broader version

A few days ago, there was an off market transaction in FirstHoldco shares. FirstHoldco is the parent company of the popular First Bank.

An off market transaction means the transaction didnt take place on the floor of the exchange.

10.43 billion shares exchanged hands at N31 in 17 deals. Thats a bit over N320 billion

Initial media reports by Thisday had indicated that Femi Otedola bought the shares. FirstHoldco has since come out to refute this.

Some other media reports had indicated the shares were held by the FG in a trustee arrangement. The AGF has since refuted this.

Who sold ?

According to the press release filed by FirstHoldco the sellers were:

Barbican capital and affiliates Barbican capital is an investment vehicle controlled by Oba Otudeko.

Leadway Group and affiliates . These are tied to the Odukale family.

PFA accounts managed by a Leadway subsidiary.

Who bought?

The same notice says the shares were bought by RC Investment Management Limited.

Who are they?

RC has ties to Rencap Africa. Rencap Africa is a financial services firm

More clarity is needed

Is RC taking a stake in FirstHoldco in their own capacity? Or are they doing so on behalf of a client?

On Friday, you also had two off market trades in Fidelity Bank and FCMB Group.

1.1 billion (1,140,866,892 to be precise) Fidelity bank shares were traded in 9 deals. Apel Asset Management was on the sell while Cardinalstone securities and Apel Asset Management were on the buy side.

There was an off market trade of 1.3 billion FCMB shares.

I expect more colour on these deals in the coming days.

Board and management changes

Austine Olorunsola, has been appointed as an Interim Chairman of Aradel Holdings Board, with effect from the 9th of July 2025.

Prestige Assurance Plc Executive Director, Mr Vivek Kalla has resigned from the Board of the Company effective 29th June 2025.

The firm’s recently appointed Executive Director, Mr Deepak Pal passed on 3rd July 2025, after a brief illness.

What’s happening this week?

I

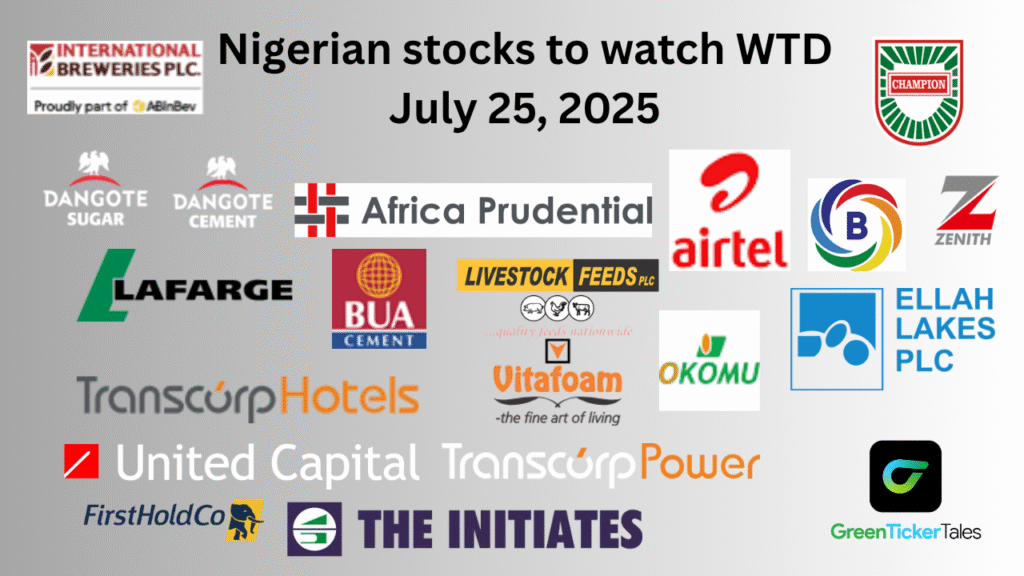

Its a packed one in terms of earnings. The picture above is comprised of mostly companies that will be having board meetings to consider their quarterly earnings. The firms may also release them same day or a few days after going by precedence.

A few names i left out with meetings this week. Neimeth and Guinness Nigeria

Banking sector is on my watchlist as the CBN monetary policy committee meets today and tomorrow. Expectations are for interest rates to be left unchanged. At best a slight cut

Moving over to the US

Last week, the

the S&P gained +0.6%,

Nasdaq Composite gained +1.5%.

The Dow dipped -0.1%.

This week remains an extremely busy one in terms of earnings

Verizon and Domino’s Pizza will drop earnings today

On Tuesday, July 22: Coca-Cola, Philip Morris (PM), Lockheed Martin will drop theirs.

On Wednesday, July 23: Alphabet and Tesla will release earnings for the last quarter

On Thursday, July 24: Blackstone (BX), Honeywell and , Intel will drop earnings

For a daily market summary of the NGX, please follow @greentickertale on twitter.

The greentickertale podcast is up on

Spotify

Apple Podcast

Youtube Music

You can find me on every other platform greentickerwarrior

Youtube

Tiktok

For one on one convos use this link

For group/community convos use this link

Have a good trading week ahead.

Leave a Reply