Champion Breweries has a public offer running at the moment which will close tomorrow. A public offer is when a company sells shares to the public

Here are my thoughts on the offer and projections on revenue and profit thereafter.

The offer details

2,625,000,000 shares at ₦16.00 per share

The offer opened January 8, 2026 and closes tomorrow January 21, 2026.

N37.2 billion amounting to 91% of net proceeds will be used for partial settlement of the Bullet acquisition and N3.6 billion for working capital.

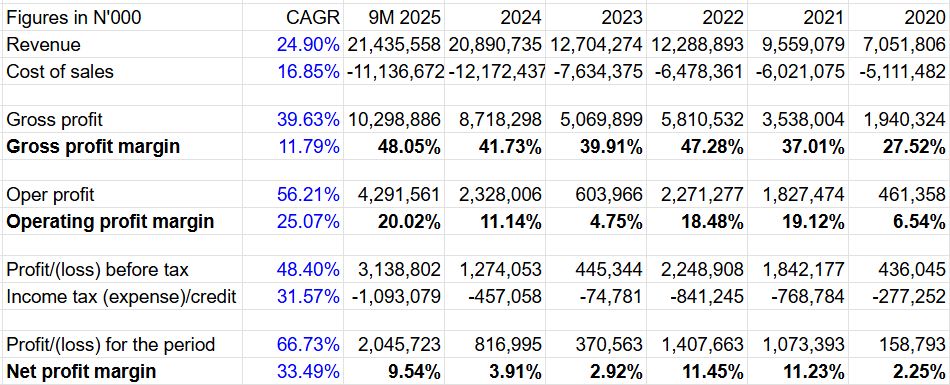

Healthy growth in profit but

Profit after tax has grown at a CAGR of 66% in the last 5 years and 9 months, much faster than revenue. The net margins at sub 10% could be much better

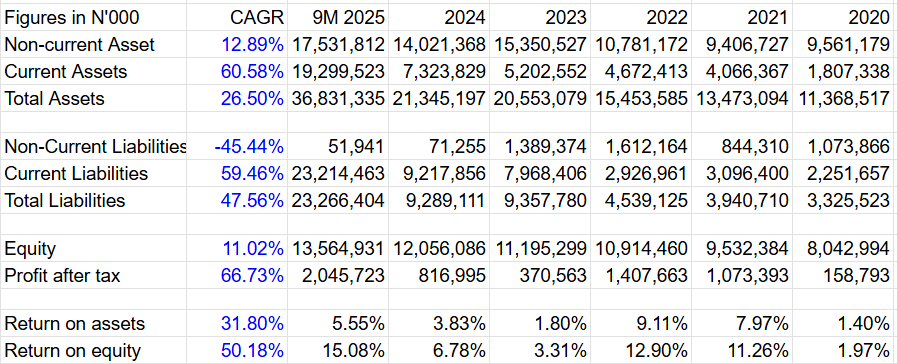

ROA and ROE CAGR

ROE (return on equity)is a financial ratio that measures how efficiently a company generates profit from the money invested by its shareholders.

While ROE has had healthy growth over the last dew years, management still needs to push it higher. This stock wouldn’t meet the cut off requirement for investing, if you take equity risk premium into consideration.

Return on Assets (ROA) is a financial metric used to evaluate how efficiently a company uses its total assets to generate a profit.

ROA at 5.55% means that for every N1 in assets, 5 kobo was generated as a return. as at 9M 2025. That is fair, but should accelerate following the acquisition.

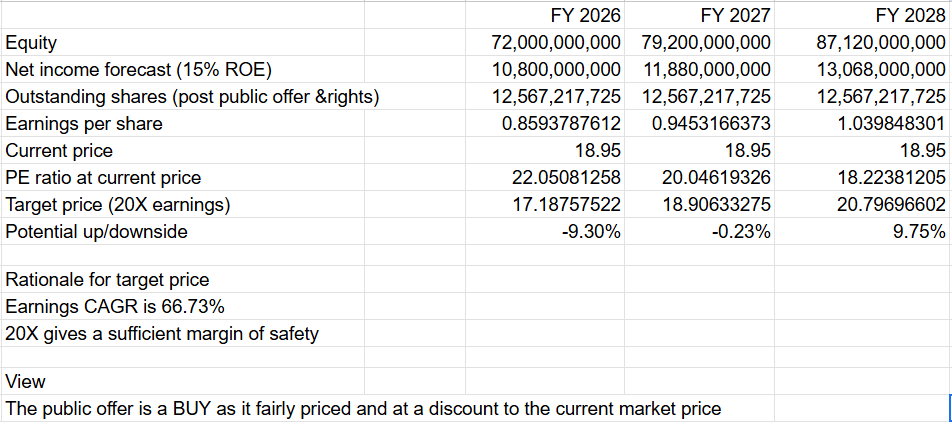

Should one buy the public offer?

The public offer is priced at N16, which is a discount to Champion Breweries current market price.

While there could be a potential downside in the stock price, if the company is able to generate a return on equity of 15% or more (which is doable), in the near term it should be muted.

Last week’s off market transaction of 9 million shares at N24, is an indication that some investors (most likely institutional) believe the firm should be trading at a much higher price.

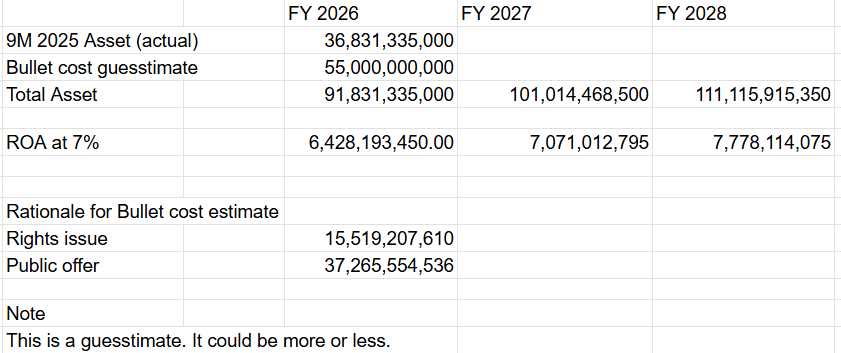

Guesstimate on the cost of Bullet

At what price could Champion Breweries be acquiring Bullet? While the numbers are yet to be disclosed (since the deal is still in the works), one can make a fairly accurate guess.

In the rights issue and offer prospectuses, the sums of N15.5 billion and N37.2 billion respectively were ear marked for the consideration of the acquisition of Bullet Africa operations. Including other costs, and one can reasonable estimate the transaction would be in the N55 billion range, or slightly higher.

Below is a forecast of what the return on asset could be going forward.

Leave a Reply