Custodian Investment has in the last few days piqued my curiosity as it traded larger than normal volumes.

Following the transactions, the company filed insider dealing notices with the NGX. There were 3 insider related transactions. Two by Olakunle Ade-Ojo and one by Adeniyi Falade an Executive Director

Between May 19, 2025- May 26, 2025, Olakunle Ade-Ojo acquired 150,000,000 shares at an average price of N19.84.

Between May 27, 2025- May 28,2025, he acquired 71,120,456 shares at an average price of ₦20.075

Why is it important?

Insider buy transactions are an indicator of confidence in the firm, as well as a belief the stock should be trading at a much higher value.

Gratitude Capital and Mike-Ade Investments are substantial shareholders in the company meaning they hold more than 5% off the company’s issued share capital.

Gratitude Capital owned 1,372,259,400 shares, or 23.33% of the company.

Mike Ade Investments owned 924,907,141 shares, or 15.72% of the company.

Both are controlled by Wole Oshin (the founded and GMD) and Olakunle Ade-Ojo

Directly

Wole Oshin held 238,674,353 4.06 shares, or 4.06% of the total.

Olakunle Ade-Ojo held 1,229,365 shares, or 0.02% of the company.

Olakunle’s acquisition means his direct stake in the firm has gone up to 3.77%, bringing his total to 19.72%.

Q1 2025 financials

Q1 22025 profit after tax rose minutely from N10.7 billion in 2024 to N10.9 billion in 2025. The marginal increase was due to weaker insurance service results (the life insurance segment in particular.

Earnings per share of N1.81, minutely better than the N1.80 made same period last year.

Where should the stock be trading at?

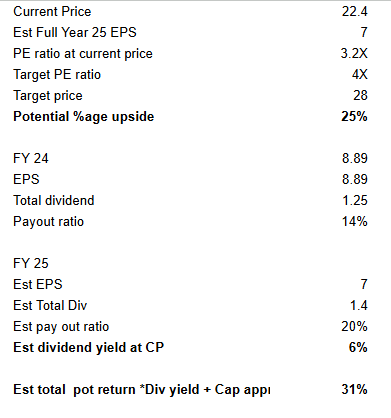

If one were to annualize (estimating the same performance for the rest of the year), full year 2025 results would come in at least N7.

That gives a potential upside of at least 25%.

You can get the breakdown below.

Leave a Reply