Pharma giant Fidson commenced its rights issue a few days ago.’ Here is a walkthrough the company’s numbers over the last few years, and a forecast of where the stock could be trading at post offer.

What is a rights issue?

A rights issue is when a company sells shares to existing investors at a set price and ratio.

Details of the issue

The rights issue is for 600 million shares at N35 per share on the basis of 1 new Ordinary Share for every 4 Ordinary Shares held as at close of business on 12 November 2025.

The issue opened on the 19th of December, 2025 and will close January 2026.

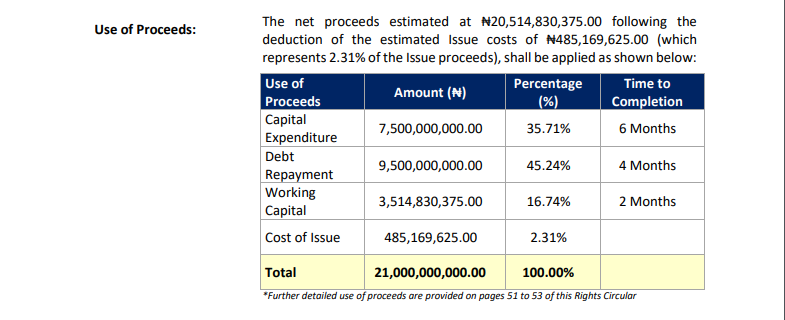

Use of proceeds

Proceeds will largely be used for debt repayment, and then balance capital expenditure and working capital.

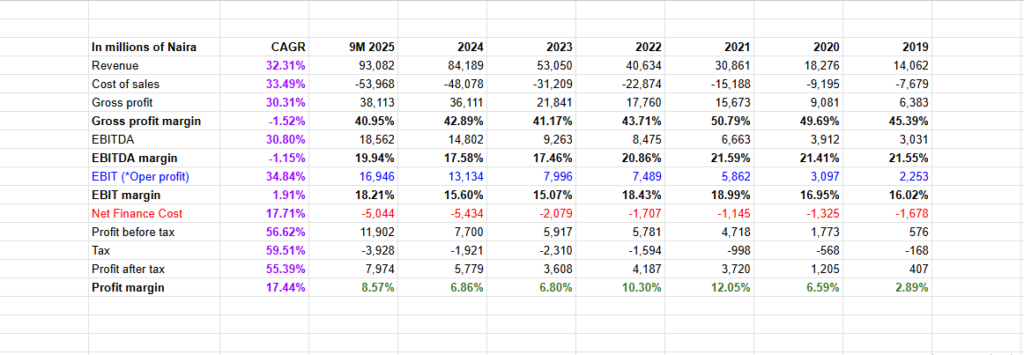

Costs are a pressure point

While revenue and profit after tax are growing at a healthy pace, finance and raw material costs are net profit margin are a bit weak.

As seen below, cost of sales in the almost 7 years below have grown at a CAGR of 33.49%, slightly higher than the 32.31% CAGR for revenue.

CAGR means cumulative average growth rate.

Net profit margin as seen above peaked at 12.05% in 2021 and was 8.57% in 9M 2025. That means that for every N100 in revenue earned in the period, N8.37 was profit.

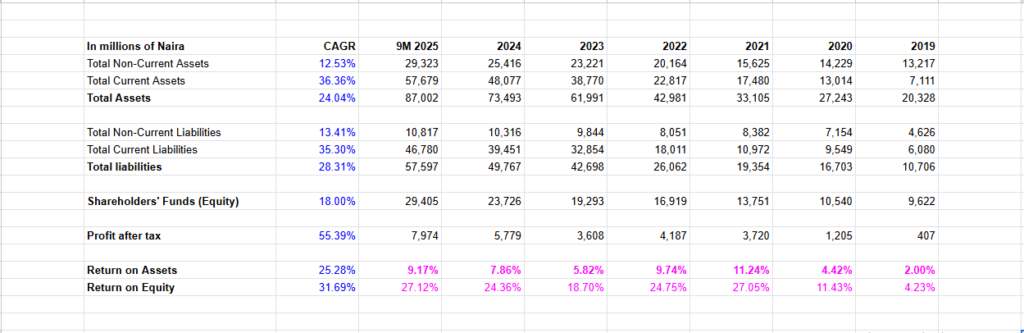

ROE is solid. ROA can be better

Return on equity (ROE) has been in double digits consistently for the last 5 years. As of 9M 2025, ROE was 27.21%. In simple terms, this means that for every N100 in equity by the firm, it generated N27.12 in returns.

Return on Assets at 9.17% isn’t shabby, but is lower than its most recent high of 11.24% in 2021.

ROA of 9.17% means that for every N100 in assets, a return of N9.17 was generated.

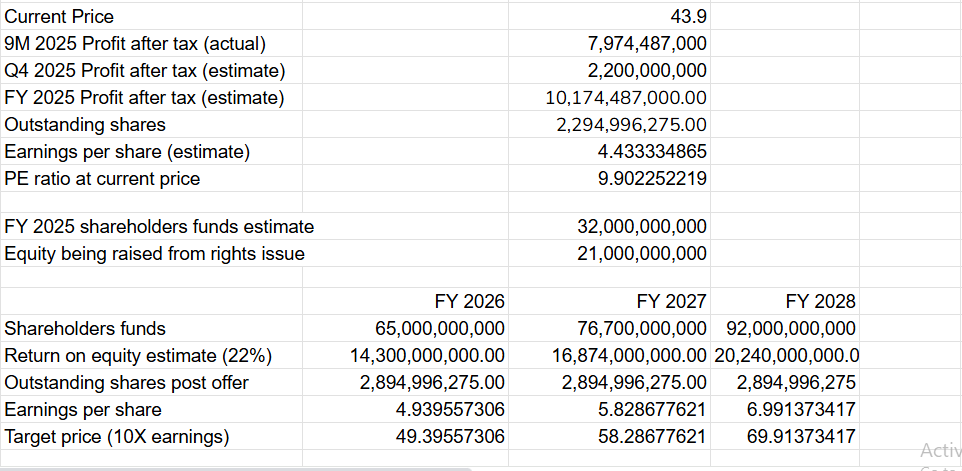

Is this rights issue worth it?

In view of the stellar return on equity, and fairly decent ROA, one can argue that buy.

The rights issue price of N35 is at a decent discount to current price of N43.9.

Profit after tax has grown at a CAGR of 55.39%

ROA at CAGR of 25.28%

ROE at CAGR of 31.69%

Net profit margins are tiny (8.57% as of 9M 2025) but could return to double digits with a significant drop in finance costs

Near term forecast post offer could have decent earnings growth and ultimately price appreciation.

Post offer

While Fidson’s FY 2026 may not show relatively high growth in earnings due to the higher outstanding shares, 2027 and 2028 will show higher acceleration in revenue and earnings per share.

Leave a Reply