Geregu Power is a generating company (GENCO) listed on the Nigerian exchange. Here’s a rundown of the company’s numbers for the half year ended June 2025

The numbers

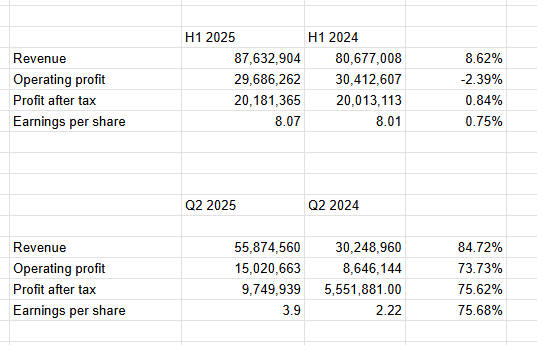

H1 2025 revenue had a marginal uptick, while profit was essentially flat. Revenue went up by 8.76% from N80.6 billion in 2024 to N87.6 billion in 2025. Profit after tax rose from N20.013 billion in 2024 to N20.018 billion in 2025.

Q2 2025 numbers were much better.

Revenue rose by 84.7% from N30.2 billion in 2024 to N55.8 billion in 2025.

Profit after tax rose at a slightly slower pace. From N5.5 billion in 2024 to N9.7 billion in 2025

Pricey but may remain so

At its current price, and assuming H1 2025 performance is maintained for the second half itself it would mean Geregu power is trading at about 65 times earnings.

This seems a bit overpriced as the cumulative average growth rate in revenue and earnings has been in the 40s. At best, the stock should be trading in the N600 to N700 range.

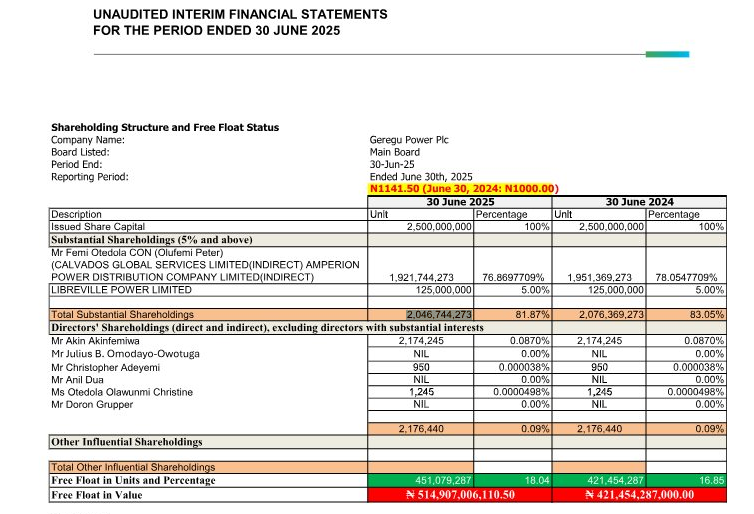

The thin float of the firm means the stock may be remain at the N1100 range for the foreseeable future.

Femi Otedola through various investment vehicles has a 81.87% stake (amounting to 2.046.744.273 shares) of the 2.5 billion shares issued by the company.

Leave a Reply