Honeywell Flour Mills yesterday released its audited FY 2025 results after trading hours.

While there was topline growth and the company returned to profit, it has opted not to pay a dividend in other to conserve capital. In the short term, this could lead to investors selling off.

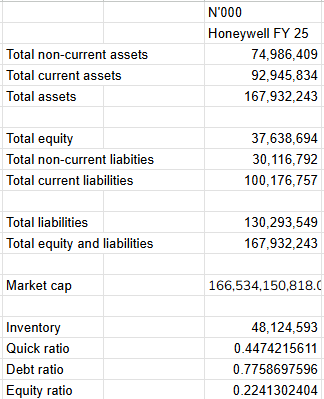

The numbers below are for the company, not group. The group includes subsidiaries which were incorporated in FY 25, and are yet to be materially significant.

The numbers

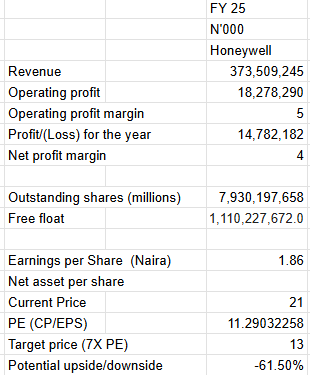

Revenue rose by 98.3% from N188 billion in 2024 to N383 billion in 2025.

The company also recorded a N14.7 billion profit after tax, in 2025 as against a N10.1 billion loss recorded in the previous year.

Finance costs notably fell sharply from N36.2 billion in 2024 to N5.4 billion in 2025. The decline was due to lower interest rate costs and exchange rate differences.

Earnings per share for FY 25 was N1.86, as against a loss per share of N1.27 recorded in the previous year.

Plant and product split

The Apapa segment manufactures Flour, Semo and Wheat meal while Sagamu segments manufacture Noodles and Pasta.

The Apapa plant returned to profit during the year, but losses worsened in the Sagamu segment.

Flour remains the bulk of revenue earned, but pasta grew at a faster pace year on year.

The company’s debt ratio seems to be a bit high, In the current interest rate environment, that may place pressure on the firm’s cash flow.

No dividend for shareholders

Shareholders that keyed into the company for dividends will be disappointed as the company has opted not to pay dividends in order to conserve capital.

Target price

I expect a downside in the stock’s price as investors react negatively to this. In my opinion, the stock should trade at 7X times earnings, which would put it at N13.

Leave a Reply