Published this on my substack a few days ago, but somehow missed this here. So thought to update.

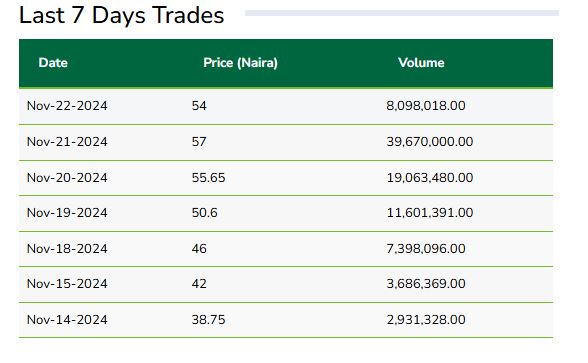

Lafarge Africa picked up steam in this week’s trading session on the NGX. The stock had back to back gains from Monday to Thursday, before dipping on Friday.

From a TTM price to earnings ratio, the stock is trading much cheaper than other players (Dangote and BUA Cement) on the NGX.

About the firm

Lafarge Africa Plc, was incorporated in Nigeria on the 24th of February 1959. The Company became listed on the Nigerian Stock Exchange in 1979.

The name was changed from Lafarge Cement WAPCO Nigeria Plc to Lafarge Africa Plc on the 9th of July2014.

Principal activities of the group are manufacturing and marketing of cement, concrete and aggregates products, the provision of building solutions and sale of power.

The cement giant operates four plants in Nigeria.

- Sagamu and Ewekoro, Ogun State (South-West),

- Ashaka, Gombe State (North-East)

- Mfamosing, Cross River State (South-South).

Holcim Limited holds a majority stake through AIC UK (27.77%) and CariCement BV (56.04%). As of December 31, 2023, Holcim Limited’s total shareholding in the company amounted to 83.81%.

9M 2024 numbers

9M 2024 revenue went up by 66% from N289 billion in 2023 to N479 billion in 2024.

Profit after tax increased by 63% from N39.3 billion in 2023 to N60 billion in 2024.

Lafarge bucked the trend compared to other players. Dangote Cement had a minute year on year increase in profit, while BUA Cement had a sharp decline in profit.

Earnings per share increased from N2.44 in 2023 to N3.73 in 2024.

While Lafarge does not provide information on its production volumes, in the 9M 2024 earnings release, Lolu Alade-Akinyemi the CEO attributed the higher profit after tax to

operational efficiency amidst heightened cost pressure. Our performance was driven by strong output due to improved plant stability, enhancement in our supply chain operations and our cost management initiatives.”

How FY 2024 may end

Q3 2024 earnings per share was N1.91. Assuming Q4 2024 earnings per share is N2, that would bring full year earnings per share at N5.73.

In FY 2023, the company paid a N1.90 dividend (from pioneer profits reserve). In the year before that, it paid a N2 dividend (about 60% payout)

A 50% payout would place FY 2024 dividend at N2.8.

Any more wind for the rally?

Though the stock shed some weight in yesterday’s trading session (dropping down N5.26 to close at N54), there is a decent probability of further upside. The stock is trading much cheaper than other players going by TTM PE ratio.

Trailing price-to-earnings (P/E) is a relative valuation multiple that is based on the last 12 months of actual earnings. It is calculated by taking the current stock price and dividing it by the trailing earnings per share (EPS) for the past 12 months.

Lafarge is trading at a PE ratio of 12.10 TTM.

Dangote Cement is trading at a PE ratio of 17.7 TTM

BUA Cement is trading at a PE ratio of 75.95 TTM

Leave a Reply