Learn Africa is one of the three listed numbers in the publishing space, the other two being Academy Press and University Press.

The company a few days ago released its results for the financial year ended March 2025.

Topline and bottomline

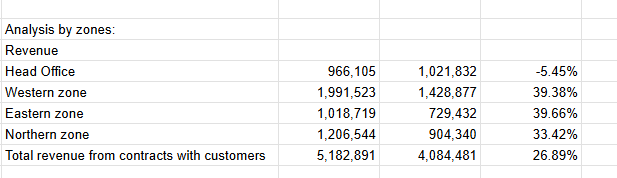

Revenue rose by 26.8% from N4 billion in 2024 to N5.1 billion in 2025.

Profit after tax rose at a much sharper pace from N260.5 million in 2024 to N748 million in 2025.

Proposed dividend

The company has proposed a 35 kobo dividend. That amounts to a payout ratio of 56.4% of its earnings (it made 62 kobo in earnings).

Qualification date and payment date are yet to be announced.

At its current price, that would amount to a dividend yield of 6.32%.

Revenue split

Revenue from the western zone accounts for the bulk of revenue made by the firm. 38% of total revenue to be exact. Same trend was present in University Press.

Unfortunately profit per region and sales according to types of books isnt provided.

View

This is not a sector with fantastic growth. Bulk of book sales are to the primary and secondary school space. So one can assume the revenue will be sticky. I dont see growth moving beyond the 15% to 25% per annum region.

From a dividend perspective, the stock is not trading at an attractive price point. If you have the dividend remaining constant.

It becomes even more attractive, if one gets in at the sub N5 mark (unlikely in this bull market, but never say never)

I have a HOLD view on this stock. Q1 2026 should provide an outlook for the current financial year.

A Hold means do not buy or sell. Please note, that is not investment or trading advice. Please do your own research.

Leave a Reply