Mecure Industries (a pharmaceutical firm) listed on the NGX joined the N100 club as it closed at N104. 2026 has seen the stock price off to a hot start. Year to date, the stock is up 59%, outperforming the All Share Index.

At its current price, the stock is a bit frothy and may be due for correction.

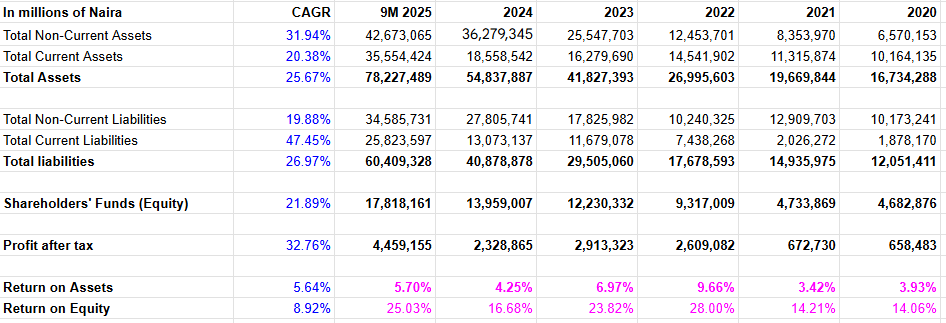

Earnings CAGR

In the last 5 years and 9 months, the company has grown its earnings at a compound annual growth rate of 32%.

If the firm is able to substitute is short term funding for cheaper longer term funding, that could accelerate in the 2026 financial year.

Between 2023 and 2025, liabilities (especially short term current liabilties) have grown at a fast clip.

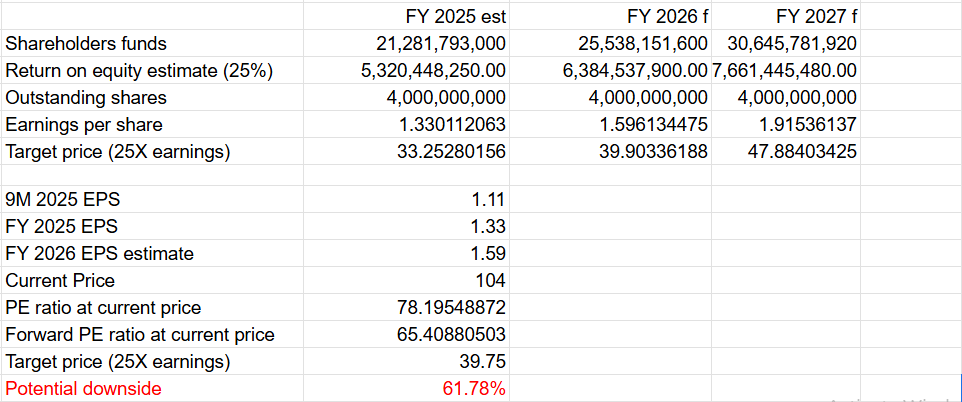

At current price, the stock is a bit frothy

At its current price, Mecure Industries is trading at a forward PE ratio of 65 times. That’s way higher than its earnings CAGR of 32%.

Going by FY 2025 likely full year earnings, the stock is trading at 78 times earnings.

Its earnings CAGR doesnt justify this price, and a correction should take place soon.

Leave a Reply