MTN Nigeria is Nigeria’s biggest telco and of the 30 biggest companies on the NGX by market cap.

Earlier this year, i had written about the company living on a prayer. Those prayers were answered some months ago, following approval by the NCC for the telcos to raise tariffs after over a decade.

Here is a brief walkthrough the company’s results for the half year ended June 2025.

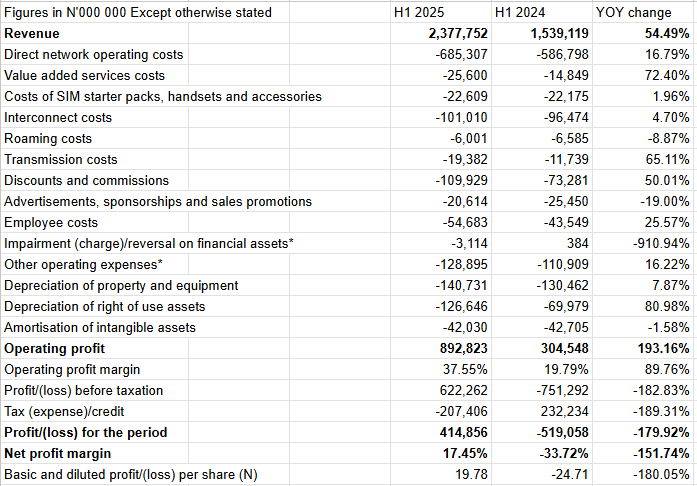

For H1, revenue went up by from N1.5 trillion in 2024 to N2.3 trillion in 2025

The company recorded a profit after tax of N414 billion in 2025, as against a N519 billion loss recorded in the same period in 2024.

FY 2025 forecast

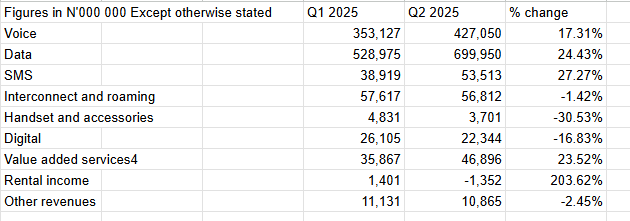

At its current run rate, the firm could easily end the current financial year with between N4.9 to N5 trillion in revenue and between N900 billion and a N1 trillion in profit after tax, if the last 2 quarters of the year come in at the same run rate as Q2 2025.

Will the firm pay a dividend?

Chances of MTN Nigeria paying a dividend for FY 2025 are quite slim in my opinion. Management would most likely prefer to rebuild equity and retained earnings from profit.

There is a decent probability the company may resume the practice of paying interim dividends in H1 2026.

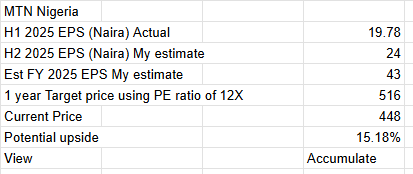

1 year price forecast

I have a one year target price of N516. That amounts to a potential upside of from where the stock is currently trading at.

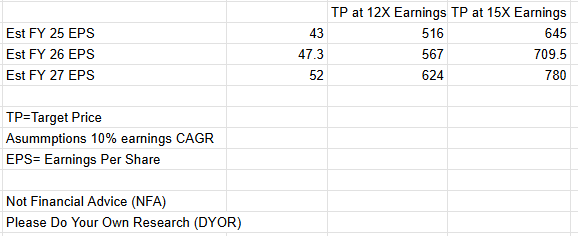

In the mid term, this stock could easily trade anywhere between N500 to N800 per share depending on what earnings multiple you adopt. I have used a 10X and 15 X multiple to illustrate. I think forward earnings CAGR should be in between both multiples.

Leave a Reply