About the company

Nigerian Breweries Plc, was incorporated in Nigeria on the 16th November 1946, under the name, Nigerian Brewery Limited. The name was changed on 7th January 1957, to Nigerian Breweries Limited and thereafter to Nigerian Breweries Plc in 1990 when the Companies and Allied Matters Act of that year took effect.

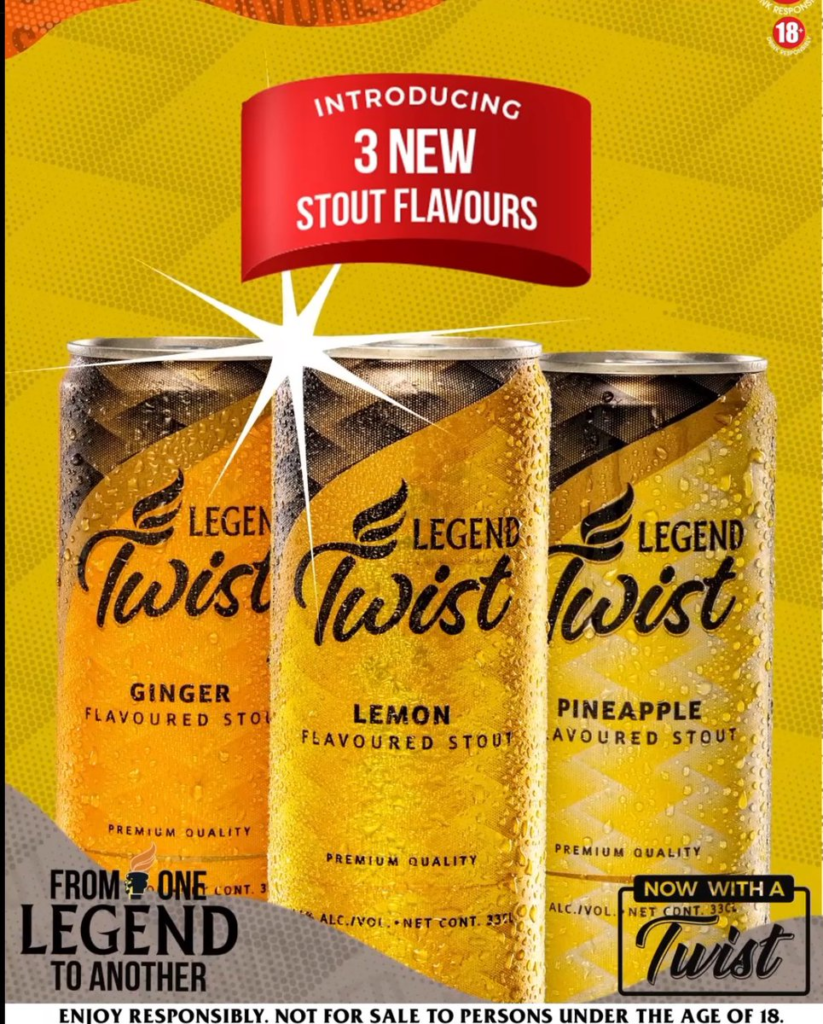

Heineken N.V, has a 56.69% stake and is the key shareholder. Popular brands under its stable include Star, Heineken, Tiger, Desperados, Goldberg, Life Continental, Gulder, “33” Export and Legend Extra Stout. Non-alcoholic brands include Amstel Malta, Maltina and Fayrouz

Still on still

The firm dropped its results for the nine months ended September 2024 after market hours yesterday.

In some ways the story Q3 is the same as last year. Revenue is growing but costs are rising hard. The further devaluation of the Naira has led to a spike in expenses, finance costs and an fx loss.

Total costs of sales, selling, distribution and administrative expenses went up by 81% from ₦375 billion in 9M 2023 to ₦681 billion in 2024.

Management shed some light on this in the earnings release accompanying the results, quoted below.

“Revenue grew by 75% driven by strategic pricing, innovation and market recovery. Gross Profit grew by 36% although lower than Revenue growth due to a 99% increase in Cost of Goods Sold. Despite this, the Company recorded strong Operating Profit supported by a robust cost savings agenda. The increase in Net Loss was again significantly influenced by FX loss due to the devaluation of the Naira and high borrowing costs arising from higher interest rates.”

In Q3 2024, the brewer made an operating loss of ₦9 billion. Same period last year it made an operating loss of ₦1.1 billion.

On a 9 month basis, there was a marginal increase in operating profit year on year. Operating profit went up by 6.5% from ₦27.2 billion in 2023 to ₦29 billion in 2024.

After that everything is back in the red. Finance costs went up over 100% year on year from ₦105 billion in 2023 to ₦232 billion in 2024.

Loss after tax worsened from ₦57.1 billion in 9M 2023 to ₦149.5 billion in 9M 2024.

Waiting for the infusion

A cash infusion from the rights issue should put the firm in a better stead. Heineken, which is the main shareholder, exercised its rights issue. A rights issue is when a company sells shares to existing investors.

The rights issue was for 22,607,491,232 shares at ₦26.50 per share on the basis of 11 new shares for every 5 shares held as at the close of business on July 12, 2024.

Net proceeds of the offer (amounting to ₦590 billion) will be used to pay foreign currency and Naira denominator debt.

Don’t expect a dividend

The firm has negative retained earnings of ₦175 billion as of 9M 2024, so shareholders should not expect a dividend for the 2024 financial year.

Leave a Reply